The Prime Minister’s Youth Business Loan scheme is tailored for young entrepreneurs aged 21 to 45. This initiative provides subsidized financing at an annual markup rate of 8.0% for 100,000 beneficiaries through designated financial institutions, primarily the National Bank of Pakistan (NBP) and First Women Bank Ltd. (FWBL). The scheme offers small business loans with a tenure of up to 8 years, including a one-year grace period, and a debt-to-equity ratio of 90:10. These loans target SME beneficiaries across all provinces and territories of Pakistan, including Punjab, Sindh, Khyber Pakhtunkhwa, Balochistan, Gilgit-Baltistan, Azad Jammu & Kashmir, and the Federally Administered Tribal Areas (FATA). The program allocates a 50% quota for women and a 5% quota for families of Shaheeds, widows, and disabled persons.

Ministry of Industries & Production (MoIP) Support

The Ministry of Industries & Production (MoIP) plays a crucial role in the Prime Minister’s Youth Business Loan scheme. MoIP has developed various pre-feasibility reports for different industries to aid prospective entrepreneurs. The ministry actively encourages youth participation through seminars, conferences, workshops, video training sessions, and media campaigns. MoIP continues to support this initiative to promote economic growth and job creation across Pakistan.

also read Pakistan Govt Announces 10Schema

Interest-Free Loan Scheme (Finance Department, Khyber Pakhtunkhwa)

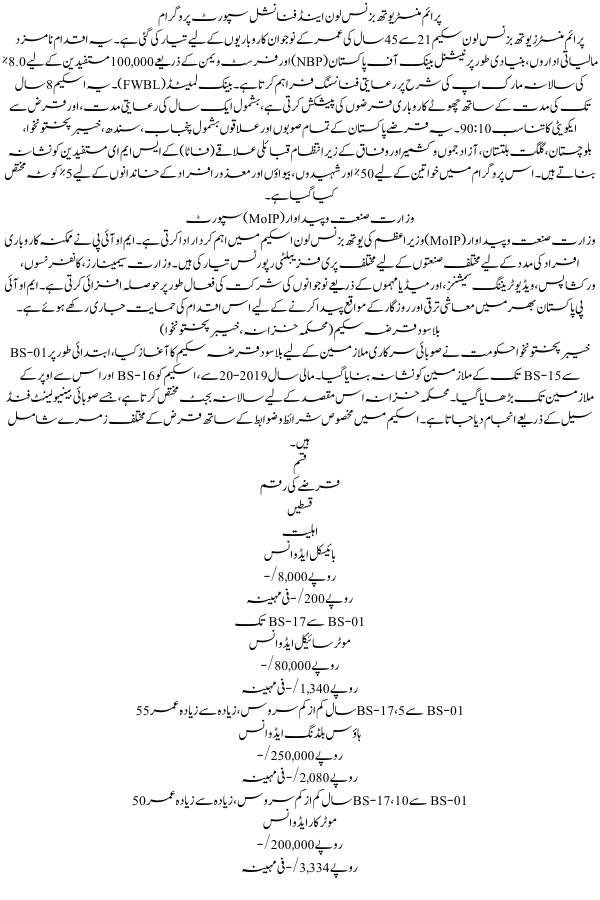

The Government of Khyber Pakhtunkhwa launched the Interest-Free Loan Scheme for provincial government employees, initially targeting those in BS-01 to BS-15. From the fiscal year 2019-20, the scheme extended to employees in BS-16 and above. The Finance Department annually allocates a budget for this purpose, executed by the Provincial Benevolent Fund Cell. The scheme includes various loan categories with specific terms and conditions.

| Category | Loan Amount | Installments | Eligibility |

| Bicycle Advance | Rs. 8,000/- | Rs. 200/- per month | BS-01 to BS-17 |

| Motorcycle Advance | Rs. 80,000/- | Rs. 1,340/- per month | BS-01 to BS-17, 5 years minimum service, max age 55 |

| House Building Advance | Rs. 250,000/- | Rs. 2,080/- per month | BS-01 to BS-17, 10 years minimum service, max age 50 |

| Motorcar Advance | Rs. 200,000/- | Rs. 3,334/- per month | BS-17 and above, 5 years minimum service, max age 55 |

The scheme mandates no quota or special consideration. Duplicationists and employees availing other loan facilities are ineligible. Loans are granted in one category only, with a possibility of reapplying after full repayment. Applications are invited annually, scrutinized, and processed through a transparent mechanism involving respective departments and the Provincial Benevolent Fund Cell.

Prime Minister’s Youth Business & Agriculture Loan Scheme

The Government of Pakistan, in collaboration with the State Bank of Pakistan (SBP), launched the Prime Minister’s Youth Business & Agriculture Loan Scheme (PMYB & ALS) for rural youth aged 21-45. This scheme aims to address term loan and working capital financing needs in the agriculture sector, offering low markup rates subsidized by the government to stimulate job creation in rural areas.

also read Ehsaas Program Registration 8171 NadraSchema

Key Features of PMYB & ALS

- Operational Jurisdiction: Applicable across all ZTBL branches nationwide.

- Eligibility Criteria: Open to Pakistani citizens aged 21-45 engaged in agricultural or cottage activities. Excludes government employees and financial institution defaulters. Genuine borrowers may get loan limit enhancements.

- Required Documents: Includes CNIC, clear e-CIB report, loan application on PM Youth Online Portal, Agri. Passbook/Fard Jamamadi/Alienability Certificate, and recent photographs.

- Maximum Loan Limit: Rs. 1.5 million to Rs. 2.5 million for Production Loans; Rs. 1.5 million to Rs. 5 million for Development Loans.

- Borrower’s Contribution: 20% of the loan amount.

- Collateral: Acceptable tangible properties; family members’ property can be used if the borrower lacks collateral.

- Cost of Credit: Includes a Rs. 100/- fee.

- Markup Rate: 7% paid by borrowers, the rest by the government.

- Sanction of Loan: Handled by the Central Loan Sanctioning Department (CLSD) at Head Office.

- Repayment Schedule: Short-term loans repaid within 5 years, with only markup paid during the first 2 years. Development loans repaid within 8 years in half-yearly installments.

- Monitoring: Close oversight by respective bank authorities, PMYP, SBP, and other stakeholders.

These comprehensive financial support programs are designed to empower youth, promote entrepreneurship, and drive economic development across Pakistan.

Quick Details

| Program | Details |

| Youth Business Loan | 100,000 beneficiaries, 8% markup, 8-year tenure |

| MoIP Support | Pre-feasibility reports, seminars, media campaigns |

| Interest-Free Loan (Khyber Pakhtunkhwa) | Loans for provincial employees, various categories |

| Youth Business & Agriculture Loan | Rural youth, low markup, production & development loans |

These initiatives reflect a robust framework for financial support, fostering entrepreneurship and economic growth nationwide.